This is Part 2 in my three-part series about relocating. Here’s Part 1, and here’s Part 3.

We spent quite a lot of energy (and cash) exploring the possibility of moving to the peninsula. First we tried to move to Ilwaco, and then we tried to move to Long Beach.

Ilwaco lot

Once we narrowed down the location to the Long Beach Peninsula, we focused on a lot in Ilwaco that was in the same neighborhood as my brother’s home.

Once we narrowed down the location to the Long Beach Peninsula, we focused on a lot in Ilwaco that was in the same neighborhood as my brother’s home.

It was actually two lots, combined to be just over 1/2 acre sitting on the top of a 250-foot hill with an asking price of $65K. Only the front, pie-shaped lot is at all buildable. It has a 10-15% down-slope back to the second lot, which is far more steeply sloped, deeply wooded, and backs into a dense forest.

We’d already learned that choosing a lot with a slope automatically adds headaches and cost to a build, so we looked at the alternatives. The majority of the land in the hills of Ilwaco is owned by an organization that has been planning a large community there for years. Their flat, easily-buildable lots are reasonably priced and have beautiful views. But the planned community is gated, which exudes an exclusionary attitude that is just not our style. Not to mention it comes complete with an HOA fee and a ridiculously long legalese-laden contract. No thanks. We’ll take the pie-shaped slopey lot.

Having found the lot, our project forked into two sub-projects. First, we had to make sure we could build a home on the lot and then buy it; and second, we had to get our current house into a sell-ready state as soon as possible.

And of course I have one spreadsheet to rule it all.

Let the games begin: preparing our house for sale

We launched into the maelstrom of packing and sale-prep. Luckily I had started on this at the beginning of the year: fixing this and that, painting, and more. I replaced the outdoor light fixtures. Changed the house numbers to a more modern style. Replaced a rotting wood outdoor banister. Repaired numerous tiny drywall issues that were the result of the house settling.

But repairs and touch-ups were a small matter next to the need to de-clutter and pack.

We had a massive collection of books and a generally cluttered home. When we had our Realtor over a year before to get her take on what needed to be done, she pointed out a few small odds and ends, but at the top of her list was that we needed to get rid of most of the books in order for it to look appealing to potential homebuyers. And while we didn’t want the place to look cluttered when it goes on the market, we also didn’t want to empty it out to the point of having to pay to have the place staged.

To say we had a lot of books is an understatement: we had at least 1200 books. Is there really such a thing as too many books? Doesn’t everyone have twelve completely filled bookcases?

Months earlier, when our search for a new home had just started to get serious, I spent several months churning on what to do with these books. First we went through them to choose the ones we will get rid of, earmarking just over half to go to new readers. I reorganized them, moving the “to go” books (nearly 600 in all) into the five large oak bookcases in the front room, and the “keepers” into the seven smaller bookcases in the TV room.

Next I photographed the to-go shelves then put together a website to show each binding. Meanwhile, my brother was in a similar position with his books. In a fit of some kind of ridiculous biblioinsanity I told him I’d take care of getting rid of his books, too, and so added about 200 of his books to mine. We photographed them, boxed them up, brought them to my place, and I added them to the website (now up to almost 800 books).

Next, I posted links to the website in my social media and emailed it to friends, offering everyone to email me a list of the books they wanted and I’d bag them up and they could come and get them. I got rid of more than 500 books in two days. I eventually gave the rest of the books to Goodwill, and my neighbor helped me sell the five oak bookcases. (Actually, I started by inviting Powell’s Books to send a buyer, but Covid had curtailed their buyers’ excursions for a while. Sadly, just a few weeks after I got rid of all the books, they said they could send their buyer.)

Getting rid of hundreds of books was high up on our list, and I was also going through closets to both get rid of things and also pack boxes for our eventual move, keeping track of everything in my spreadsheet. By just a few months into this madness, we were living in a home that was distinctly uncluttered, but piled up in a few places with stacks of boxes. A huge step in the right direction, but still more to do to truly be ready to sell.

And the games go on: can we build on that lot?

Meanwhile, back in Ilwaco, we still had many, many hoops to jump through: because there is so much more to building a home than simply building a home!

First we contacted a local Ilwaco Realtor to help us buy the lot, and we also sent information about the lot to the home building company with which we’d been talking with for the last six months: HiLine Homes.

When I helped my brother remodel his Ilwaco duplex in 2010, we worked with a local architect, Dave Jensen. I would very much have enjoyed working with him again on this project, but our budget meant we needed to go a different route: hence our decision to go with HiLine (here is more about that).

Our new Realtor, a long-time resident of the area, was skeptical that HiLine would be comfortable with our slopey lot, and so put us in contact with a local architect. He said that he’d had the architect meet him at the lot to walk the land together and they both agreed that, while it certainly was an odd-shaped, slopey lot, something could surely be done with it.

Next, we haunted the Ilwaco city website to gather information about permitting requirements, and we called the city planner to discuss our project. He visited the lot and emailed a few days later saying that the lot was outside of any restricted areas, send us the plat info, and to recommend a firm to do a formal geotech study to document the slope, erosion, soil, etc. He also recommended a local excavation company who could help assess whether a home could be built on the lot.

While we waited for the geotech report, we talked with the excavator and sent information about the lot to HiLine. The excavator came back with a positive assessment, but said that he’d have to clear the lot of the rather massive kingdom of blackberries and brush to really be sure. The following photo shows me on the lot, and that massive brush on the right that goes all the way up and beyond the top of the photo is all blackberry.

As we didn’t yet own the lot, we needed to arrange the clearing with the owner (at our expense, of course), so we got in touch through our Realtor. The owners said they were fine with us clearing the brush, but that we had to also haul away the resulting piles of debris. So, without having yet actually purchased the lot, we were looking to already spend $3,850:

- $650 for the geotech report

- $1300 to clear the brush

- $1900 to haul the debris away

And this is where we paused. Should we really spend nearly $4K on a lot before we know that we can even build a single-level home there within our budget?

We got word from HiLine that they were probably not interested (because they prefer to only work with lots that are closer to level). Our Realtor recommended an architect to work with, but it took nearly two months of him not replying to emails or voicemails for us to finally connect with him. He said he thought that our budget might be in the ballpark, but that it will be tight. Also, he said the slope of the lot means the house will need to be up on either a daylight basement, pylons, a lower-level garage, or some other such option. It wasn’t ideal, but I guess this is okay. At least being higher up on the lot means an even nicer view. He said he would research some options and come up with a preliminary budget to help us determine if we could build the type of home we wanted on the lot.

It took several months of waiting for information and for decisions to be made, all with me sitting on the edge of my seat for so long that I was about to fall off. What we learned in the end was that we’d probably have to go at least $60-90K over our budget to build on the lot.

We could build a beautiful home with amazing views in a neighborhood we liked, but it wasn’t worth killing the budget. We decided we had to let this lot go. But we learned some important lessons:

- Relationships matter. We would have saved ourselves several months of stress if we’d gone with the architect I already had a good relationship with rather than the architect our Realtor recommended.

- Budget. Budget is important, but this will be a home that we live in for the rest of our lives. We still have a goal of living mortgage-free after all the dust clears, but perhaps we decided that, for the right lot, we’d change that to “nearly mortgage-free.”

- Package home builders. There are more ways to build your own home than starting from scratch with an architect. Your home might not be the custom beauty that sprang from your vision if you go with a package home builder like HiLine or Adair, but their library of floor plans might be just fine… as long as you have a flat lot.

- Start with a HELOC. Don’t want to have to sell your existing house until after you’ve started work on your lot? If you have good equity in your existing home, look into getting a home equity line of credit (HELOC) to fund buying the lot and doing the lot prep.

Back to the drawing board…

Long Beach lot

After the frenzy of getting rid of excess belongings and packing up about a third of what we owned, I was very discouraged when our hopes to build a new home in Ilwaco fell apart.

After the frenzy of getting rid of excess belongings and packing up about a third of what we owned, I was very discouraged when our hopes to build a new home in Ilwaco fell apart.

Rather than putting our plans on hold, we switched into a more passive gear. We added ourselves to several real estate mailing lists, kept a very critical eye on the results, and waited.

After many months of “what about this one” false alarms, we found property in the northern part of Long Beach, which is one of the communities north of Ilwaco on the Long Beach Peninsula. We drove the 2.5-hour trip and met the Realtor there to see it. It was a 5-acre lot, which is about 4 more acres than we’d initially wanted, but the prospect of being surrounded by forest was too good to pass up: We bought it.

The purchase was was conducted virtually, and we were aided by a wonderful Realtor who helped us with the contingency inspections. The whole process took about two weeks from start to finish, with the lot formally becoming our property in October 2021. We made plans to visit the lot the following weekend.

That Saturday we headed due west from Beaverton on Highway 26 and wound our way into the mountains toward the coast. The sun had only just risen, and the views were fantastic. We were on a schedule, but couldn’t resist stopping for a fast photo.

Turning north at the coast onto highway 101, we drove through Seaside, into Astoria, and across the four-mile Megler bridge onto the Washington side of the Columbia River. Even after about twenty years, I can never resist taking countless photos of the Megler every time I cross it.

Once across the Columbia onto the Washington side, we drove for about twenty minutes west to the Pacific coast, enjoying the views of Oregon across the river.

In Ilwaco we were joined by my brother, Tim, then we continued aother 20 minutes due north to the northeast part of Long Beach and to our wooded lot.

When we say this is a wooded lot, we aren’t kidding: this lot has quite a few trees as well as dense brush and undergrowth. In addition to taking lots of pictures, we were here to destroy some blackberries and cut some paths through our new woods to see just what we had purchased. While I had brought my gardening gloves and new clippers along, Tim was heavily armed with a machete and more.

Once we were parked in front of the lot, our first task was to find the best entrance to make our way through the underbrush onto the property. Dave and I followed Tim’s lead.

There were many branches and even full small trees on the forest floor. While there had been a significant storm the weekend before, much of this was buried in dense layers of leaves and moss. There was no telling how many winters they had lain there.

We spent several hours trekking across the lot, frequently checking our mobile devices to [attempt to] keep our bearings while cutting a meandering path to the wetland on the west end of the lot.

We will not know where we can build the house until we receive a wetland delineation report, but we came across several spots that may end up being where the trees will be cleared and our house built.

We lost our way several times and encountered impassably dense bits of the wood that has us doubling back. But what finally succeeded in ending our day’s adventure was our pressing need for lunch. Tim and I struck an American Gothicesque pose for photographer Dave, then we headed to the cars and off for a meal. Many more trips to the lot will follow.

You bought a wetland?!

One would think that after buying our lot that we’d be frantically completing the many, many steps toward prepping the lot and building our new home. But we’d owned our 5-acre Long Beach wetland lot for about five weeks, and yet we had not gotten started. We would have already had bulldozers on the lot if it were almost anywhere else, but because a considerable portion of our lot was a wetland, we were in standby mode.

Our new lot was on a tiny peninsula on the west coast of the US in southwest Washington, between a lake and a bay, with the Pacific Ocean less than two miles away to the west.

We had enough elevation that we didn’t have to worry about flooding, but water was still going to be a constant presence in our lives. [However, this lot is in a tsunami hazard zone, which is a whole other topic for another time.]

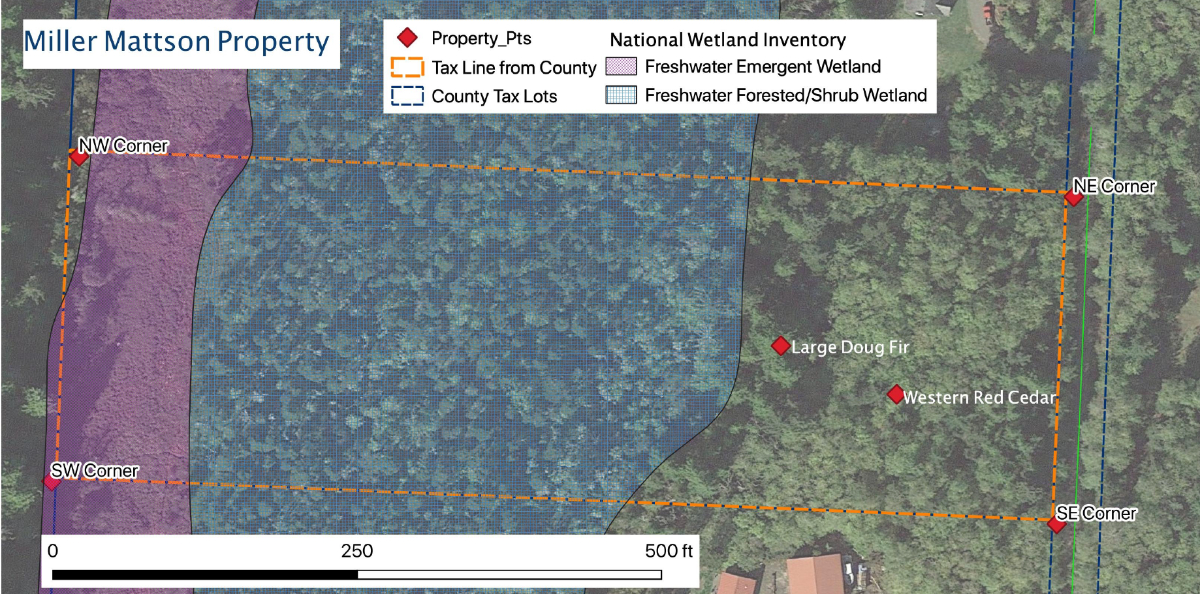

Before we purchased the lot, we knew that the west side of it was a wetland, but we didn’t know how much of it was, nor the extent of the limitations it would place on us. In aerial/satellite photos of the lot we could see a diagonal line down the middle, so we figured our house would need to be built to the east of that line, as the neighbors to the south did, as shown in the image below.

My sister-in-law, who lives not far from the lot, is involved in native plant and wetland restoration and is familiar with local plant ecology—so she knows a thing or two about this and was incredibly helpful to us. She hiked the land a bit with her GIS device and was able to indicate some boundaries. She sent us the following image, indicating that the majority of the lot was designated as “freshwater forested/shrub wetland.”

This was no surprise, and after a photo excursion to the lot with some of my family, I can certainly confirm that this is an apt name. There is a slight dip in elevation at the border of the wetland, then you cross into an area covered with little pools of water, although it is so densely wooded and covered with fallen trees that it is hard to hike far into it.

“Freshwater forested/shrub wetland,” indeed! On this little trip to the wetland part of the lot, three of the four of us ended up accidentally submerging at least one of our feet in ankle-deep pools of water.

“Freshwater forested/shrub wetland,” indeed! On this little trip to the wetland part of the lot, three of the four of us ended up accidentally submerging at least one of our feet in ankle-deep pools of water.

(These photos are from the actual “wetland” part of the lot. The eastern end where the house was to be built is not covered in puddles!)

So, what does all this talk about wetlands have to do with our having been in standby mode instead of frantically arranging to build our house?

Every county has its own rules, but in Pacific county, there are four categories of wetlands, each with its own county-mandated guidelines on how close one can build to it, which can be as much as 300 feet. While the line of the wetlands is easy to see, the actual category of the wetlands is not. Also, the required boundary around the wetland is decided on a case-by-case basis, meaning we had to wait until a full “wetland delineation report” can be created. Which we are told should be completed in the following January.

After researching the rules a bit, we assumed that in the very worst case, we would be forced to build within the east-most 1.5 acres of the lot. This is closer to the road than we would like, but it would work. But the more likely scenario is that we would be able to build on the east-most 2 or even 2.5 acres.

So we were on hold for now. Once we get that wetland delineation report, we could start on those many frantic steps with the hope that we could actually be in our new home in a year. Putting in septic and a well, clearing a place to build, putting in a private road, and so on. And on, and on…

But for now, we wait.

Wetland delineation report

Finally, in March, after owning this 5-acre lot for just over five months, we could finally take the next step toward building our home: We finally received the wetland delineation report.

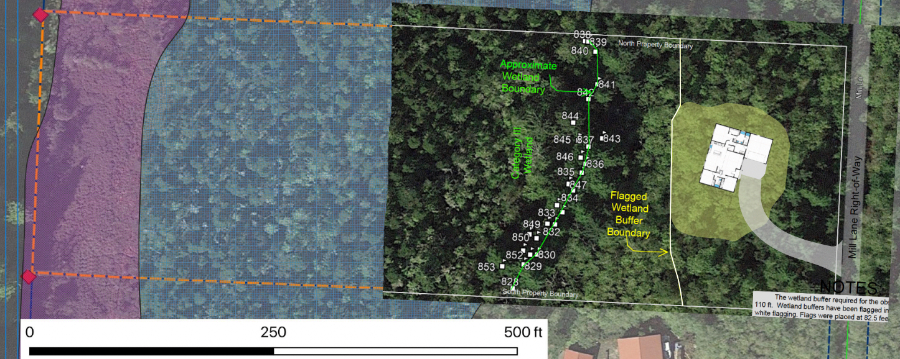

The wetland expert determined that ours is a Class III wetland, which requires a 110-foot buffer. He marked the official wetland delineation boundary with pink flags, then measured the distance of buffer and marked that with white flags.

We can build right up to the wetland buffer, but there can be no development at all beyond the wetland delineation line. The wetland expert worked out a bit of a compromise where the buffer line nearer the center of the lot is a little closer to the delineation boundary in exchange for the area south of it being further away. This is shown in the below graphic, which shows our lot with the right-most line showing the boundary up to which we can build.

We went into this knowing that we’d be building on the eastern part of the lot. This is a smaller build area than we expected, but when you’re standing in this “small” part of the lot, it seems pretty big. In fact, the size of this area far exceeds any back yard I’ve ever had. Not the 1.5 to 2.5 acres I’d envisioned, but it would be just fine.

The above graphic is complete with a guess at where we would position our cleared area with the house and driveway. But we couldn’t be sure until we had another expert visit the lot to determine the slope of the land and where we can build.

Yep, that’s right: another expert. Here are the next steps that we needed to take before any building could take place:

- determine placement for house

- get the permits

- clear the building space of brush/trees

- level and prep the house location

- electricity hookup

- well

- septic

- build the driveway

- finalize paperwork with builder

We went into this knowing that things move slowly when you’re in a small community, so this wasn’t driving us too crazy. Yet.

The previous year when we bought the lot, we started out with the goal of having the house built by the end of 2022. Soon we realized that we’d only be able to finish the lot prep by then, which pushed the house build to 2023. Now I was thinking even that might be optimistic and that the prep would finish in 2023 and the house build would be in 2024.

A lot would depend on what happened in the next few months. Here are a few new photos from my trip to the lot that weekend. It was very rainy, so not quite ideal photography weather.

Saying Goodbye to the Long Beach Peninsula

Ah, our beloved Long Beach wetland. Five remote(ish) acres on Mill Lane, where if you stand very still you can hear nothing but the birds and the distant waves of the Pacific Ocean.

Ah, our beloved Long Beach wetland. Five remote(ish) acres on Mill Lane, where if you stand very still you can hear nothing but the birds and the distant waves of the Pacific Ocean.

We were looking so forward to making this our home, but our plans changed: We sold the lot in June 2022.

Why?

First, building costs went sky high. The impact that Covid had on the economy is felt all over. The cost of wood quadrupled, and other necessary ingredients for building a home—drywall, windows, and more—became more expensive, difficult to get, or both. Eventually our builder let us know that the quote for building our home went up by 7%, and there was no guarantee that it wouldn’t continue to rise in the many more months we would have had to wait before we could sign the contract and start the build.

Next, the housing market went into a bubble. It’s nice to look at the current estimated value of our home and fantasize about spending that on our new place… but prices can’t climb forever. During our wait, the common belief became that we were officially in a bubble. Because we wanted to avoid renting, our plan was to stay in our current home until the new house was ready to move into. But what would happen if we signed the contract for an expensive build, then the housing bubble bursts and the value of our home tumbled?

Our plans with this move were made so that when all the dust of the build and the move cleared, that we would be living mortgage-free. But now the risk became too high that we’d end up with a much higher mortgage than we have now.

So, no. We can’t do that. It was a sad decision, but the right one to make: we contacted the Realtor who sold us the lot and asked him to list it. It took only about a week to sell and we were able to recoup our expenses, so all is well… but it’s still a bit sad. Here are a few parting pics:

Every time we hiked the lot, we’d find golf balls from a neighbor practicing their long drive. Below is the pile we harvested during a hike there on just one day.

Our friends Jen and Lisa and I headed to the coast for a quick visit, and we spent a short bit of that on Mill Lane. It was a very bittersweet visit. A final goodbye.

So what’s next? We had no idea. We were very lucky in that we really like the home and the neighborhood where we are in right now. Maybe we’d find a new home on the coast, or maybe we’d stay right where we were in Beaverton. Either way, we were comfortable and satisfied, and open to whatever the tides of consequence happened to place within our view.

And then we found a home in Clatskanie…